TradRES’ Pan-European Case Study

- Buildings,

- Electricity,

- Hydrogen,

- Transport

- Extended European area

Context

The Pan-European case study in the TradeRES project identifies drivers of market prices and profitability of variable renewables in different scenarios of the future Pan-European short-term electricity wholesale market.

This is an external use case of Mopo tools implementation.

Scope

- Geographical scope: it covers multiple European countries, focusing on electricity markets, sector coupling, and renewable integration across the continent.

- Sectoral scope: electricity sector, hydrogen, transport and buildings.

Scenarios

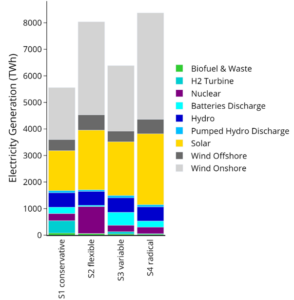

The study explores the characteristics of fully decarbonized European electricity markets by optimizing four main scenarios that differ according to three scenario dimensions:

- the degree of coupling between the hydrogen and power sectors

- the level of demand-side flexibility in the personal traffic and building heat sectors

- the market penetration of variable renewables.

Scenario 1 is a conservative case, featuring moderate sector-coupling and moderate demand-side flexibility, lower levels of European hydrogen production via electrolysis, and a moderate degree of supply-side variability.

In the flexible scenario S2, demand-side flexibility increases and European hydrogen production also rises.

In contrast, in the variable scenario S3, demand-side flexibility and sector-coupling remain moderate, and European hydrogen production stays lower, while the share of variable renewables is set to be higher.

Finally, in the radical scenario S4, this highly variable electricity supply is combined with a high degree of demand-side flexibility and sector-coupling, as well as higher levels of European hydrogen production, making S4 the scenario that represents the most fundamental changes compared to today’s power system.

| Scenario | Sector-coupling | Demand-side Flexibility | European Hydrogen Production via Electrolysis | Share of Variable Renewables | Overall Characterisation |

|---|---|---|---|---|---|

| S1 - Conservative | Moderate | Moderate | Lower | Moderate | Conservative case with moderate coupling, flexibility, and variability. |

| S2 - Flexible | Higher | Higher | Higher | Moderate | Flexible scenario with increased demand-side flexibility and hydrogen production. |

| S3 - Variable | Moderate | Moderate | Lower | Higher | Variable scenario enforcing a higher share of variable renewables. |

| S4 - Radical | Higher | Higher | Higher | Higher | Radical scenario with extensive changes: high variability, strong coupling, high flexibility, and high hydrogen production. |

Results and conclusions

Contrary to expectations, electricity prices in future decarbonized systems will not always reflect the low variable costs of renewable sources. Instead, prices may frequently exceed these costs due to the opportunity costs of cross-sectoral demand, particularly from electrolyzers and other flexible technologies. Electrolyzers play a significant role as a price-setting technology, especially in scenarios with high levels of variable renewables and sector coupling.

The results suggest that the current market design is generally suitable for the fully decarbonized future electricity market, as it can result in efficient price signals. However, this only holds true under certain conditions, namely perfectly competitive markets for all energy carriers and a perfectly integrated flexible demand-side.

While resulting price levels exceed variable renewables’ low cost in a substantial number of hours, the exact levels are uncertain and depend on whether these conditions materialize. Consequently, market actors are exposed to significant price risks.

Market actors are likely to require instruments to mitigate these risks. Contracts for Difference constitute such an instrument. Their design should be chosen carefully, as it has important implications for market outcomes and investor risks.

References

Johanndeiter, S., Helistö, N., & Bertsch, V. (2025). Does the difference make a difference? Evaluating Contracts for Difference design in a fully decarbonised European electricity market. Resource and Energy Economics, 83, Article 101495. https://doi.org/10.1016/j.reseneeco.2025.101495

Johanndeiter, S., Helistö, N., Kiviluoma, J., & Bertsch, V. (2025). Price formation and intersectoral distributional effects in a fully decarbonised European electricity market. Advances in Applied Energy, 20, Article 100245. https://doi.org/10.1016/j.adapen.2025.100245

Helistö, N., Johanndeiter, S., & Kiviluoma, J. (2024). Accelerating wind power investments through lower financing costs. IET Conference Proceedings, 187-193. https://doi.org/10.1049/icp.2024.3788

Helistö, N., Johanndeiter, S., & Kiviluoma, J. (2023). The impact of sector coupling and demand-side flexibility on electricity prices in a close to 100% renewable power system. In 2023 19th International Conference on the European Energy Market, EEM 2023 IEEE Institute of Electrical and Electronic Engineers. https://doi.org/10.1109/EEM58374.2023.10161962